Even though it may feel like it at the time, being denied credit is not the end of the world. Even to clients in charge of their business, it occurs more frequently than you may believe. The credit card you applied for will be approved regardless of your credit history. Other times, there's a reason you never gave your rejection any attention.

The Possible Reasons for Your Application's Rejection

Some large credit card issuers will approve applicants with no or limited credit history. However, most issuers prefer applicants with at least a year or more of consistent credit history. Even if you've always been a reliable client, you might need a longer credit history to get approved. If that's the case, it's important to maintain good credit habits like paying bills on time and minimizing your use of credit cards so that your credit history can grow.

You might have a bad credit rating.

The minimum creditworthiness criterion for each credit card is different. There is no hard and fast rule, but higher premium cards generally demand great credit.

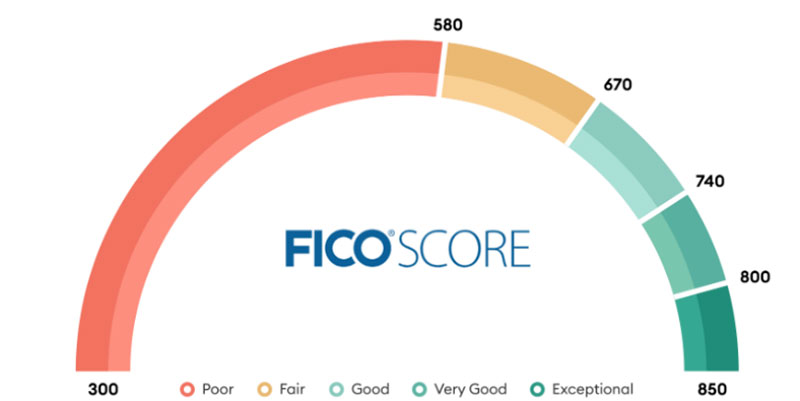

It was not uncommon for application forms to make oblique references to a minimum credit score. If you find descriptions of scores broken down into these FICO categories, you can use them to determine whether or not you're qualified for a certain card.

An Established Pattern Of Payment Delays

Your FICO score is based on many factors, so keep that in mind. A history of late payments—or never paying your card—as well as constantly using your cards to the maximum or having a high utilization rate, are crucial concerns.

You can raise your FICO® Score quickly and easily with Experian BoostTM.

By monitoring your phone, utility, and popular streaming service bills, Experian may help you raise your FICO® Score. Results could differ.

You may have opened up too many credit card accounts.

Common reasons for application rejection include an excessive number of recently opened accounts. Some issuers have clear rules about the maximum amount of cards they may issue, such as Chase's "5/24" Regulation. Due to this rule, customers are discouraged from applying if they have opened five or more accounts in the past 24 months, as their application is often denied immediately.

You can have a negative history with the issuer.

You will be given more consideration for approval if you ask for a new card from an issuer with whom you already have an account or have in the past.

Customers who have a history of canceling their cards soon after receiving them or who apply for cards but never use them aren't a good investment for the bank. In addition, your card issuer may permanently cancel your account if they determine that you are "gaming the system" by fraudulently accruing points.

Your earnings are too little to cover your expenses.

You are required to include your current income on almost all credit card applications. This will be taken into consideration while deciding whether or not to admit you. Credit card companies only want to extend credit to people who are likely to spend what they earn.

If your income has increased due to a new job or other factors, the card issuer may need you to wait a few months before considering you to be financially secure before issuing you a new card.

You should check your credit report for possible mistakes.

There is likely an error on your credit report if you believe you are the ideal applicant but were nonetheless rejected. You can analyze your credit report for free to learn whether anything was reported improperly. Some common errors include delinquent accounts that aren't late, wrong balances, and accounts that are misrepresented as open or closed. Examine your credit report carefully, and if necessary, raise any complaints.

Boost Your Credit

Although repairing your credit may seem like an enormous effort, it's pretty simple if you take it step-by-step and are dedicated to long-term change. A credit report can show you where you stand financially so you can make the necessary changes. It would be best if you prioritized not missing any bill payments, reducing your utilization rate, and paying off any outstanding debt you may have.

Top Credit Cards to Look Out for in 2023

No one credit card is ideal for every household, every transaction, and every financial situation. We have chosen the top credit cards to be the most valuable to as many readers as possible.